The Federal Reserve cut its federal funds rate by 25 basis points, as expected. However, the Federal Reserve added some hawkish rhetoric in the press conference. It announced that it is raising its 2025 inflation expectations from 2.1% to 2.5%. It also sees unemployment at 4.3% at the end of 2025, which is lower than previously expected. The current rate of unemployment is 4.2%.

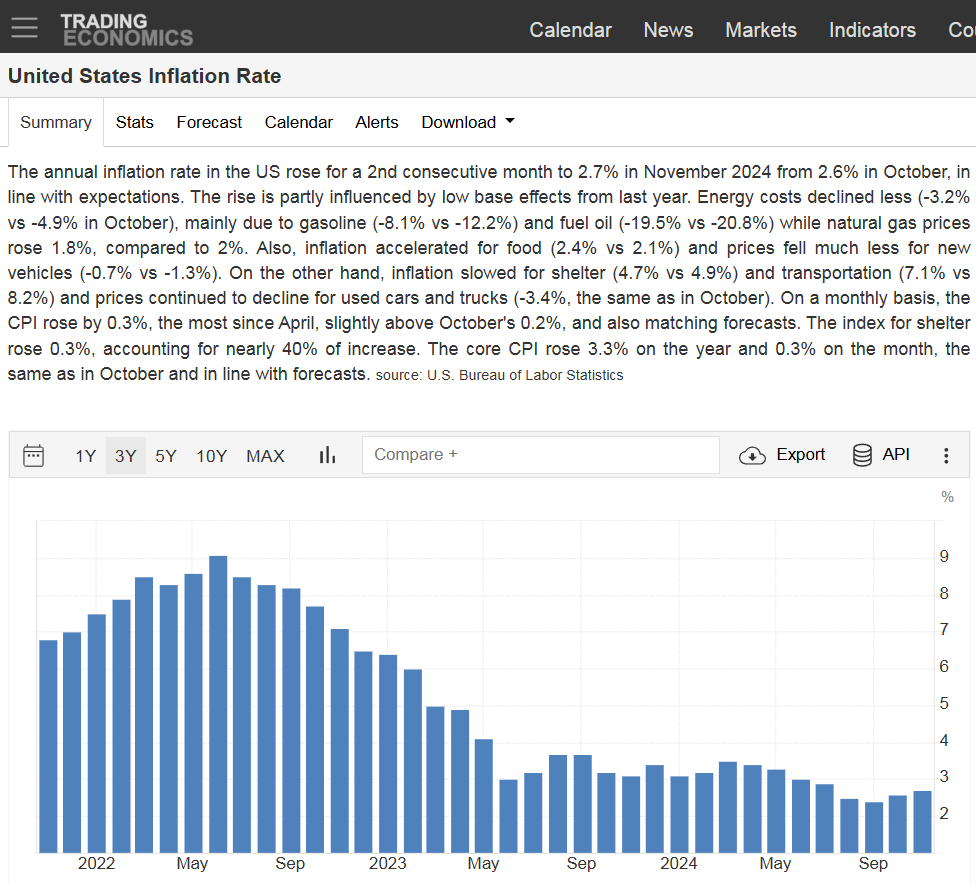

The Federal Reserve claims that it is data dependent, which is turning out to mean that they are being reactive to the last data point. It is appearing more and more that the Federal Reserve is flying by the seat of its pants. In September, the Federal Reserve was dovish and made a 50 basis point rate cut. It has now become hawkish. With inflation ebbing and flowing with no clear trend for over a year, it appears that the Federal Reserve is shifting its position with the ebbs and flows.

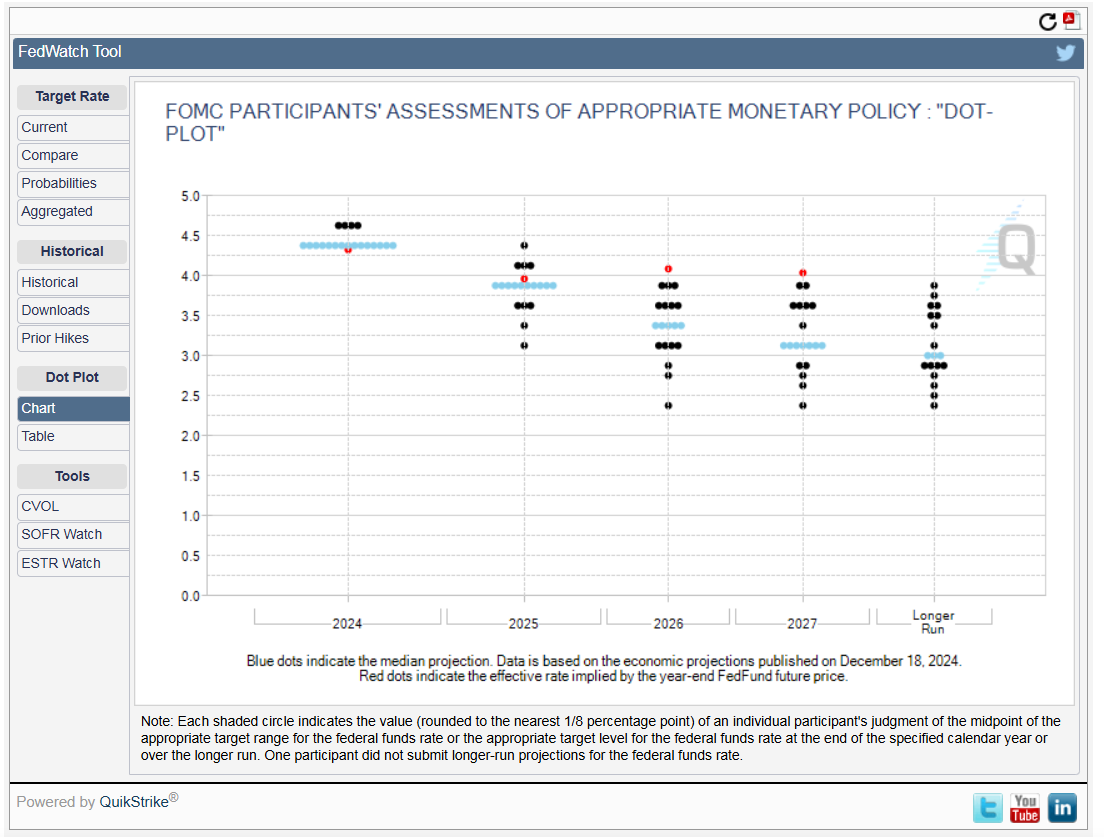

A big deal was made in the media that the Federal Reserve was previously expecting 3 rate cuts in 2025 and now is expecting 2 rate cuts. This was concluded from the dot plot, where the Federal Reserve governors state their expectations for the federal funds rate over the next few years. The dot plot has historically been wildly inaccurate and should not be given too much credence.

The stock market did not like the hawkish rhetoric and was sacred that inflation could increase further with stable growth, not giving the Federal Reserve a chance to continue to lower its federal funds rate very much further.

The S&P 500 is currently overextended with poor market breadth and was susceptible to a negative catalyst. As a result, the S&P 500 reacted poorly to the Feds rhetoric, the VIX spiked and the yield on the 10 year Treasury Note climbed sharply.

There is a a possibility that we could follow the path of the Powell Pivot in December of 2018. At the Federal Reserve meeting on December 19, Powell raised rates into declining market. The reaction from investors was sharply negative. Shortly afterwards Powell “promised” that he would not raise rates further (pivoted), and on Christmas Eve day (December 24), the S&P 500 started a multi-month rally. Let’s hope the Santa Powell comes early this year.