The Canadian dollar is in trouble. It has been declining over the last two years and has recently dropped below $0.70.

The price of oil has been moving sideways over the last few months and has not really helped the Canadian dollar. The US two year yield has been rising and increasing the spread of the US dollar over the Canadian dollar which has had a negative impact on the Canadian dollar. This has been a huge factor. In addition, the US dollar has been performing very well relative to world currencies, making it difficult for the Canadian dollar to perform well.

What was once support ($0.70) is now resistance. It is going to be difficult for the Canadian dollar to break above this level, but if it does, $0.72 is going to be very difficult to break.

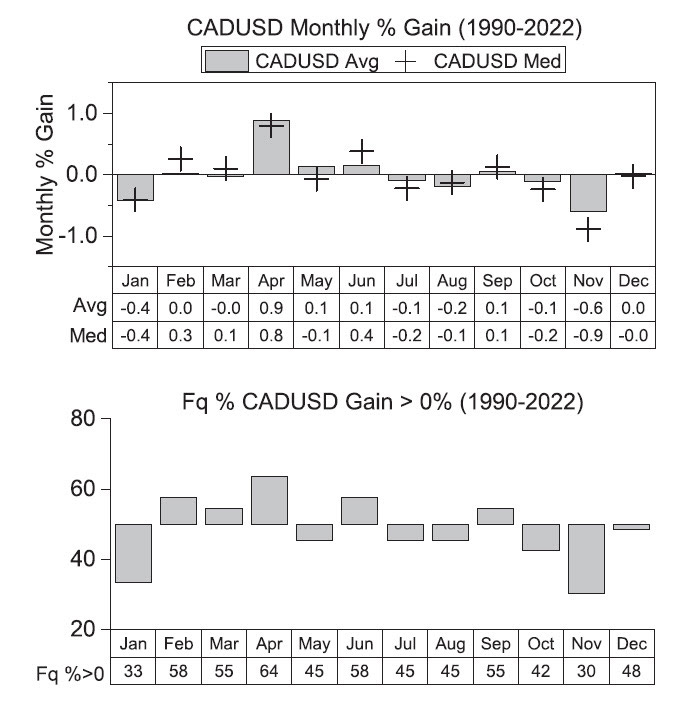

Seasonally, the US dollar performs well against world currencies in January as new orders are signed internationally, increasing the demand for the US dollar. The Canadian dollar also tends to perform poorly relative to the US dollar in January.

There could be more pain to come for the Canadian dollar.