At the end of last week (ending December 27), there was some profit taking as the growth sectors, consumer discretionary and technology underperformed.

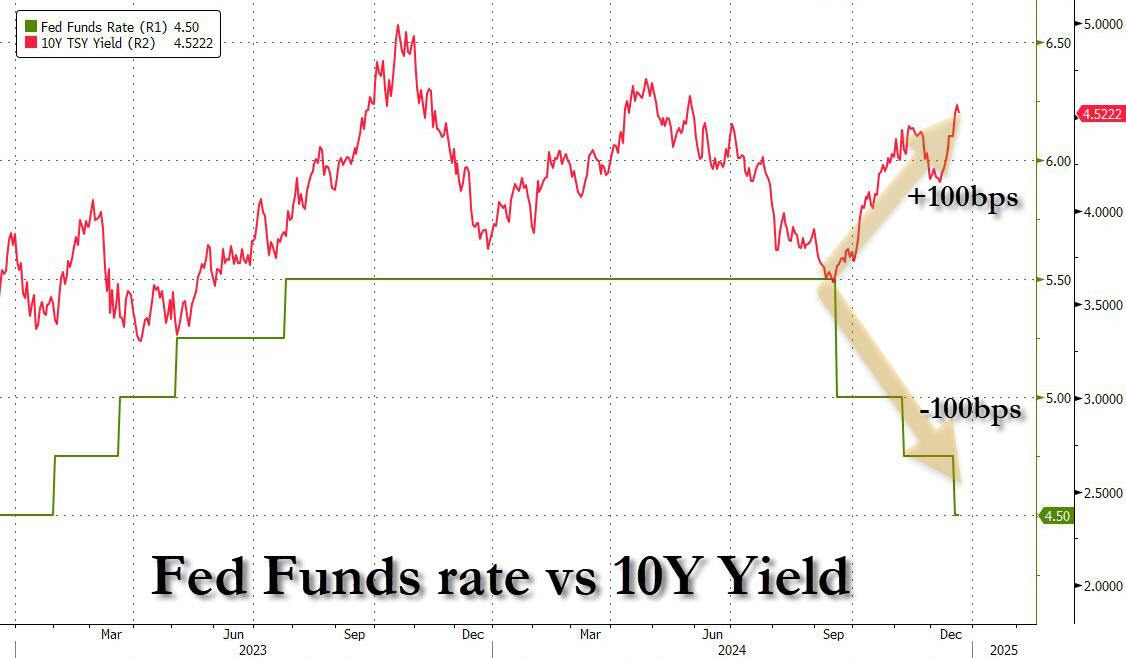

It has been tough for the markets as interest rates have been rising. The yield on the 10YR US Treasury has increased by 1% since September 16. At the same time, (the Fed started to cut its federal funds rate on September 18), the federal funds rate has increased by 1%.

The Federal Reserve cut by 1% and the yield has increased by 1%.

Reasons:

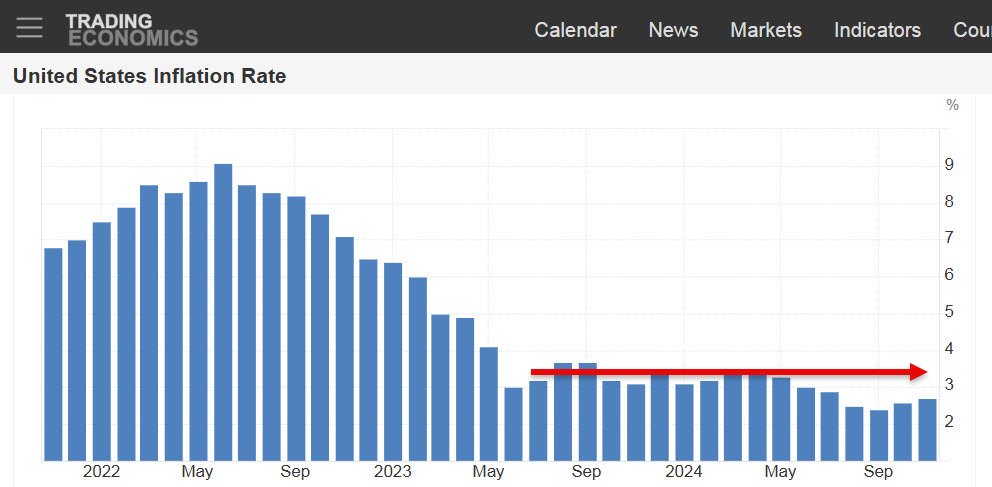

(1) Inflation is still a concern

(2) Economy is still okay

(3) Huge bond issuance coming due in 2025.

Yellen has been financing government debt at the short end of the curve. Typically, the government finances its liabilities with 15% at two years and under with its bonds. Yellen has financed over 30% at two years and under. This was done to provide more liquidity into the markets, but is a huge mismanagement of government obligations. There is over $7.6 trillion dollars coming due in 2025 and are going to have be financed at higher interest rates. This is a problem and bond investors are concerned.

It is not just rising interest rates that have been difficult for the markets, but also a rising US dollar.

Rising yields have been pushing the US dollar higher.

A lot of investors are looking for the the same trends to occur with interest rates and the US dollar, as took place in 2016 when Trump was elected. When Trump was elected, the US dollar and the yield on the 10 Year Treasury Note increased dramatically into mid-to-late December, peaked and headed lower in 2017.

I am not so sure the same trend is going to occur at this time. There are some complicating factors taking place in January as Trump takes power.

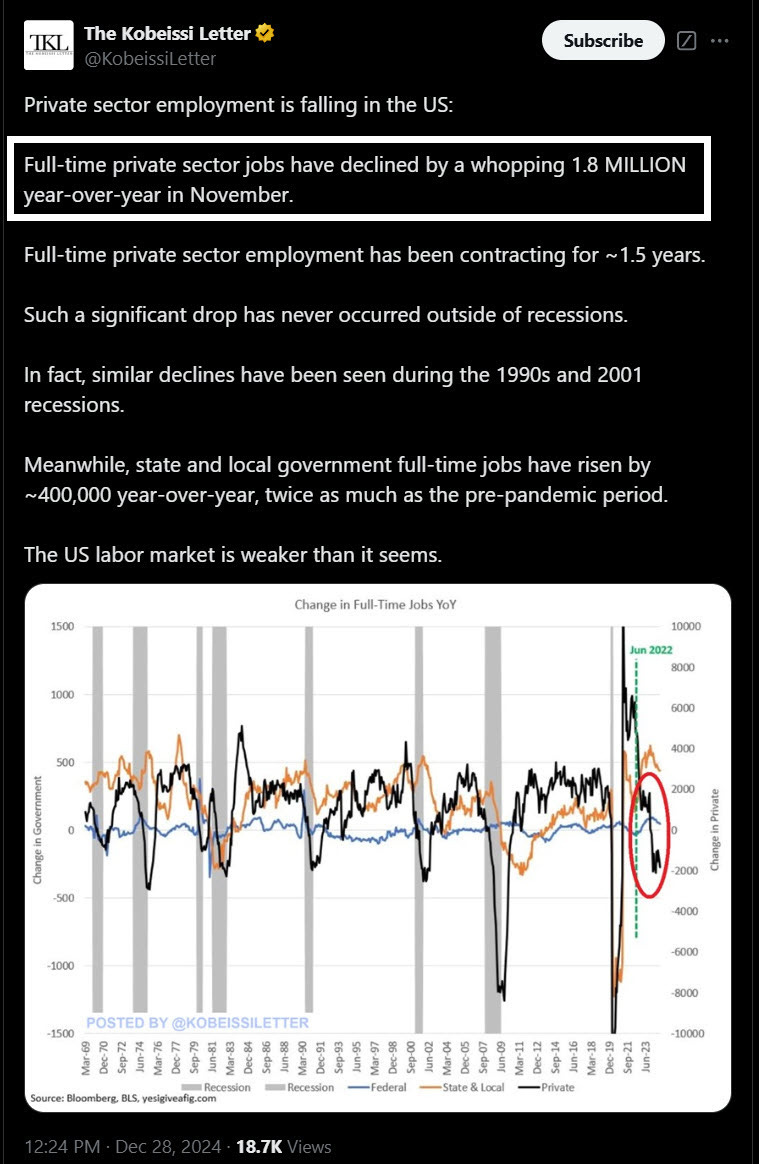

The big narrative for 2025 will probably be the unemployment situation. Although the unemployment rate is low, there are some troubling numbers. Private employment has been dropping like a rock. Private employment decreased by 1.8 million people from November 2023 to November 2024. Although the base effect is exaggerating the situation, there is a huge private employment problem.

The government has been hiring people hand over fist. Mainly local and state governments with all of the COVID money they received. This should never have taken place at the scale that happened. It was irresponsible and is now ending. When government employment drops off, the employment numbers will get worse.

I think that the Federal Reserve’s prediction that unemployment will rise to 4.3% at the end of 2025 from 4.2%, is way off. We shall see.

What should we expect in the markets coming up?

I was on BNN Bloomberg, The Street, on Friday December 27. I discussed how low credit spreads at this time indicate that bond investors do not perceive risk in the economy at this time. This transfers into the stock market.

https://www.bnnbloomberg.ca/video/shows/the-street/2024/12/27/outlook-for-credit-spreads/

The stock market tends to be strong in late December and early January. It is possible that would see the stock market bounce from here as profit taking before yearend winds down.