The S&P 500 has performed poorly so far in December.

The rising US dollar since October has weighed on the market.

The rising yield on the US Treasury 10 Year, has also weighed on the stock market.

Last week, the Federal Reserve made a “Hawkish Cut,” of 25 basis points, expecting only 2 rate cuts next year, versus three previously.

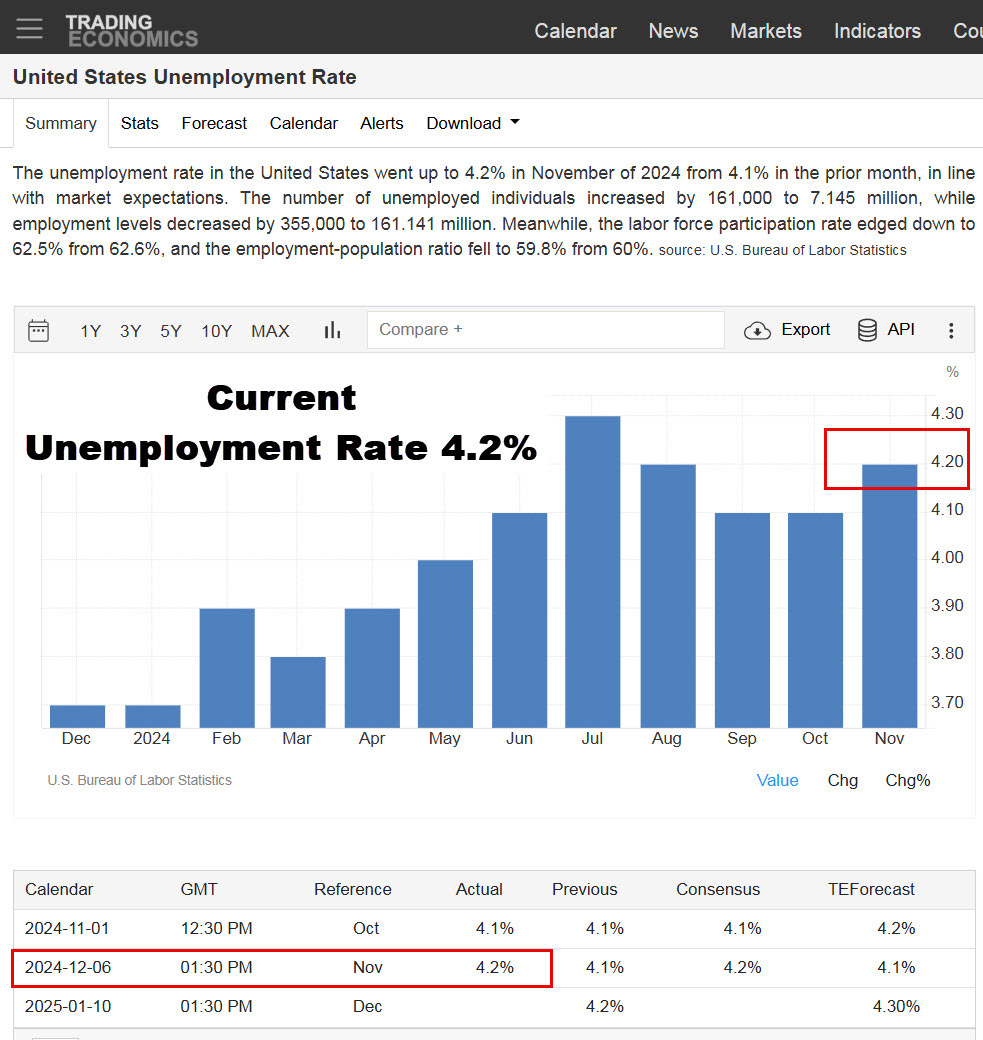

In addition, the Federal Reserve expects core PCE inflation to be 2.4% at the end of 2025, which is higher than the previously expected 2.1%. It also expects unemployment to only tick higher to 4.3%.

Last week, the S&P 500 was negative, with all of the major sectors of the S&P 500 negative.

The S&P/TSX Composite was down 2.7% for the week.

There is hope for the stock market to perform well for the remainder of the year, into the new year. Reflecting back to 2018, Powell raised the federal funds rate on December 19. At the time the stock market was suffering and continued lower on the rate hike. A few days later, Powell virtually promised that he would hike the rate any more. The stock market bottomed and turned around on December 24.

We are getting close to the end of the year. The stock market has become oversold. In particular the S&P/TSX Composite has become oversold.

On a seasonal basis, the stock market tends to perform in the few days before Christmas and the few days after Christmas. Let’s hope that Santa comes to town and arrives before Christmas once again.