Gold is up over 30% in 2024 and it could still move higher before year end.

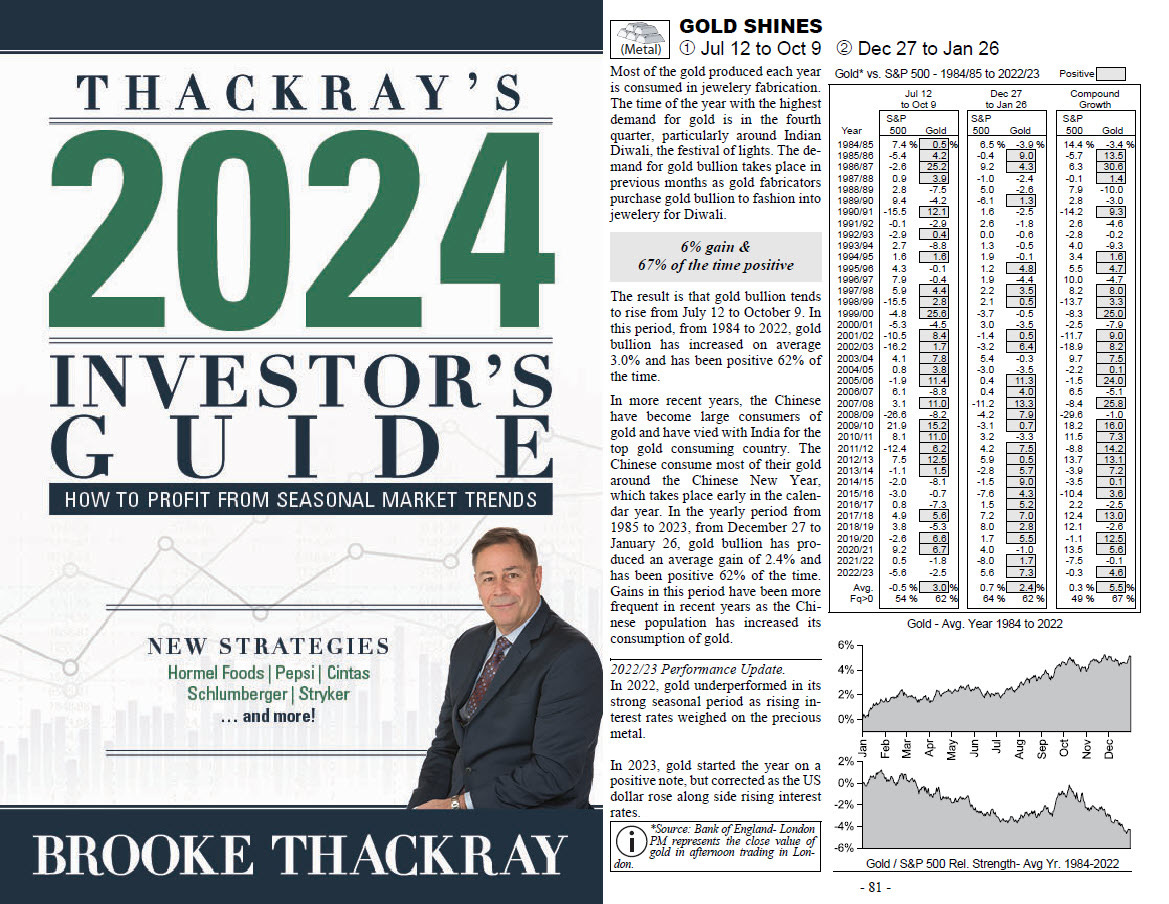

According to the Thackeray's 2024 Investors Guide, there are two strong seasonal periods for gold. One's from July 12th until October 9th and the other one's from December 27th until January 26th. The latter is just a few weeks away and what drives this seasonal period is the large purchases from Chinese consumers heading into Chinese New Year. Chinese consumers have been large purchases of gold this year helping to keep the gold price higher and there could be even more buying coming up as we approach Chinese New Year.

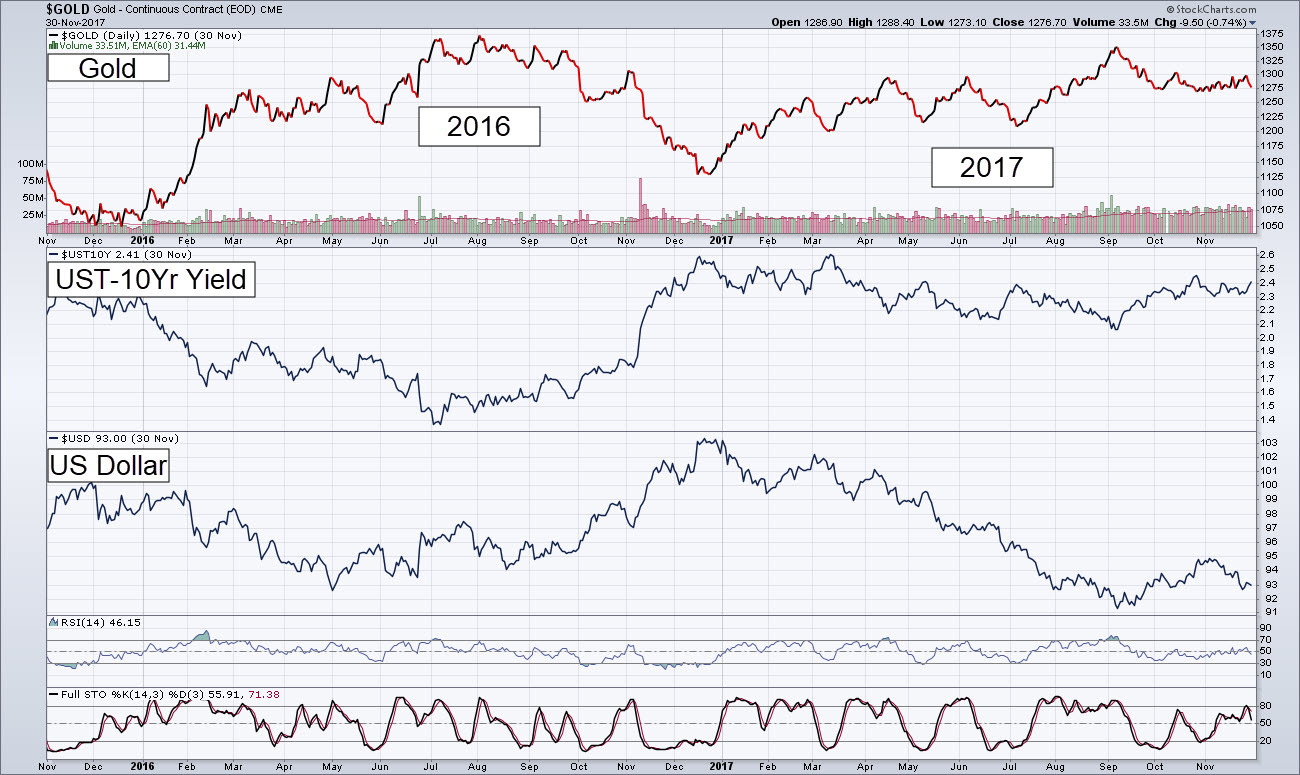

To see what's happening with gold right now, I want to go back to 2016 when Donald Trump was first elected. Now of course there are some differences, but there are some similarities.

When Donald Trump was elected in early November, gold actually went down and it went down quite a bit and quite fast. If we take a look at the yield on the 10 Year Treasury Note, it went up and it went up a lot very quickly. It's not only direction that matters, it's also magnitude.

We saw that gold move up very sharply into mid-December and the same the US dollar went up fast and it started to roll over in mid-December. The combination of the higher the rally in the 10 year yield plus the US dollar heading higher were very difficult for gold to overcome.

As a result, we saw the gold head lower. The yield on the 10 year Treasury note peaked in mid-December and the US dollar peaked in mid-December as well. Both started to roll over and gold started to perform well once again. There's a lot of similarities with this setup, with what's being taking place right now and what happened in 2016.

If we look at the last couple of years we could be in a similar technical position. In both periods gold was improving its technical profile heading into its strong seasonal periods seasonal periods in 2022 and 2023.

In 2022 gold bottomed in early November. Typically, the strong seasonal period starts on a certain date and six to eight weeks before that, we're starting to consider the technical signals for the trade. The full stochasitcs oscillator went below 20 and came back above indicating that perhaps gold could start at a strong seasonal period early. And that's what happened. We did see gold actually perform well right into the end of January, which is the end of a strong seasonal period for gold as well.

In 2023, gold was lower coming into October and it put a bottom in. The RSI went below 30 and became oversold and then crossed back over 30. So we started to see improving price momentum. So this triggered a buy signal. And if we take a look at the full stochasitcs oscillator, it went below 20, and then we had a crossover and then it came above 20. It also triggered a buy signal. So the two of these together is a good indication of improving price performance.

And the RSI is more important, but when the RSI and full stochastics oscillator both trigger a buy signal that is a good sign.

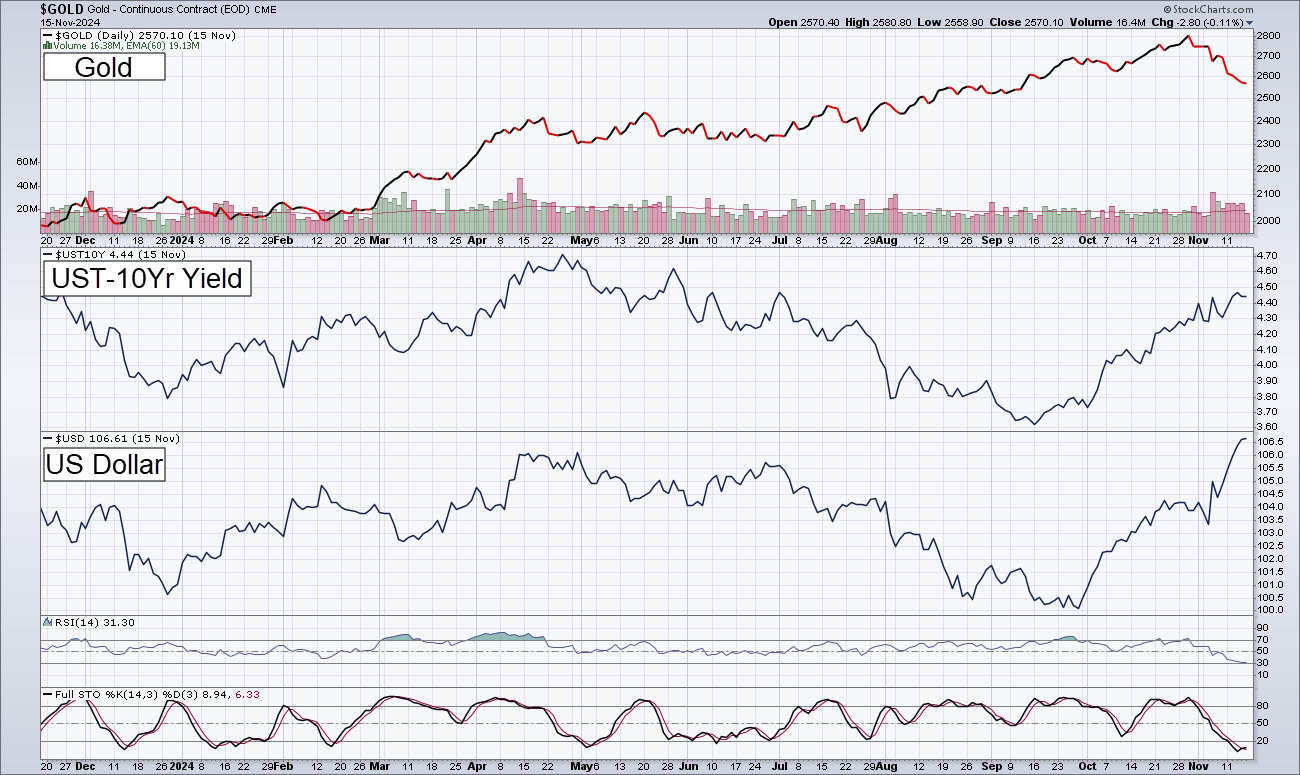

In 2024, we saw gold perform well in its strong seasonal period from July until October. Since late October, gold started to pull back. Now the RSI is down to almost 30, with gold on the threshold of being oversold. And then the full stochasitcs oscillator become oversold and is just starting to turn higher with a crossover below 20, triggering a possible early buy signal.

We are starting to see some improving price momentum.

Two of the other variables I'm watching right now to help determine the direction and magnitude of gold rally, or if it is set to decline are the) yield on the Treasury Note and the US dollar.

When both interest rates and the US dollar both go up and they both go up fast, that's a very challenging environment for gold. That is what has been happening recently. The yield on the 10 Year Treasury Note bottomed in mid-September, around the time Powell started to cut the federal funds rate. And then he US dollar bottom shortly afterwards. And then they both started to go up. Gold was actually still doing well, despite these challenges.

Gold peaked really in late October and then started to roll over. Shortly afterwards Donald Trump become elected. As a result the US dollar had a rapid ascent with a lot of money pouring into the US dollar. At the same time, we had yields increasing. It was just too much for gold to overcome and as a result gold decreased in price.

It is not only important to monitor the technicals which have turned positive from a price momentum standpoint, but also what is happening to the US dollar and interest rates. If we start to see the US dollar lose some of the strength relative to world currencies, that would help to give gold a boost. Likewise, if we start to see the yield on the 10-year Treasury note head lower, that would give gold a boost. If both the US dollar and interest rates head lower, that could provide rocket fuel for gold coming into its strong seasonal period.